Average withholdings from paycheck

There is an annual income ceiling for Social Security tax adjusted annually. Estimate your federal income tax withholding.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Your wages after allowances that exceed 1548 would be subject to a 25-percent tax plus a flat amount of 20105.

. How Your Paycheck Works. The Withholding Form. Weve identified 11 states where the typical salary for a Withholding Tax job is above the national average.

Subtract line 5 from line 4. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. Each percent is applied to only a portion of the workers income not the total amount so no one is paying the government 396 of their earnings.

For employees withholding is the amount of federal income tax withheld from your paycheck. Massachusetts beats the national average by 57 and Tennessee furthers that trend with another 5987 86 above the 69962. The amount you earn.

The TCJA eliminated the personal exemption. Use this tool to. FICA taxes consist of Social Security and Medicare taxes.

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. Combined the FICA tax rate is 153 of the employees wages. See how your refund take-home pay or tax due are affected by withholding amount.

Your employer pays an additional 145 the employer part of the Medicare tax. 10 12 22 24 32 35 and 37. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. Choose an estimated withholding amount that works for you. The federal withholding tax has seven rates for 2021.

Using the chart you find that the Standard withholding for a single employee is 176. Here are the steps to calculate withholding tax. Employers stop deducting Social Security tax up to that amount once an employee.

Employers must also withhold an additional 09 235 total of Medicare tax on earned income of more than 200000 in a tax year. However they dont include all taxes related to payroll. That number drops to 71 percent for family plans.

You find that this amount of 2025 falls in the At least 2020 but less than 2045 range. Withholding percentage that is less than line 9. The withholding tax amount depends on a number of factors so youll need the employees W-4 to help with your calculations as well as the withholding tax tables and the IRS.

Balance of withholding for the calendar year. The federal withholding tax rate an employee owes depends on their income level and filing status. That means you shouldve had an extra 119 in every paycheck last year.

Social Security tax is calculated using gross wages with no deductions. For help with your withholding you may use the Tax Withholding Estimator. Of course each business will have a different plan and set up.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. First gather all the documentation you need to reference to calculate withholding tax. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

2 So lets say you got paid twice a month and received the average refund. Divide line 1 by line 2. The withholding rate for Social Security tax for 2018 is 62 percent.

The amount of income tax your employer withholds from your regular pay depends on two things. Results are as accurate as the information you enter. Topping the list is Tennessee with Minnesota and Massachusetts close behind in second and third.

For example the cap in 2018 is 128400. Add 20105 to 16923 to get total withholding per biweekly paycheck of 37028. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

IRS data shows that the average tax refund for the 2021 tax season was 2856. The information you give your employer on Form W4. Ad Compare and Find the Best Paycheck Software in the Industry.

There are no income limits for Medicare tax so all covered wages are subject to Medicare tax. This is wages per paycheck. This all depends on whether youre filing as single married jointly or married separately or head of household.

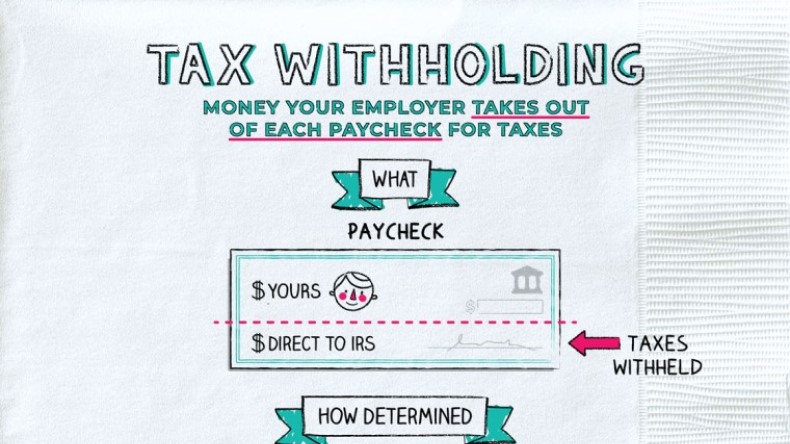

The Basics of Withholding Withholding refers to an employers responsibility to pay each employees estimated income tax by directing a percentage of gross taxable wages to the government tax office rather than paying it directly to the employee. FICA taxes are commonly called the payroll tax. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Subtract line 11 from line 8. If a low paycheck is preventing you from meeting your medical bills or medications car title loans may be able to finance your needs. What is the percentage that is taken out of a paycheck.

Example rates include 10 percent 25 percent 33 percent and 396 percent. Multiply 67691 by 25 percent to get 16923. Subtract 1548 from 222491 to arrive at 67691 which is your excess wages.

This means that your federal tax liability increases as you earn more money. These amounts are paid by both employees and employers. This is your Arizona withholding goal per paycheck.

You can find the amount of federal income tax withheld on your paycheck stub. Simplify Your Day-to-Day With The Best Payroll Services. Its been years.

Divide line 6 by line 7. On average 82 percent of single-person insurance policy premiums are employer covered. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

For state income taxes Arizona offers seven withholding percentage options.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Understanding Your Paycheck Credit Com

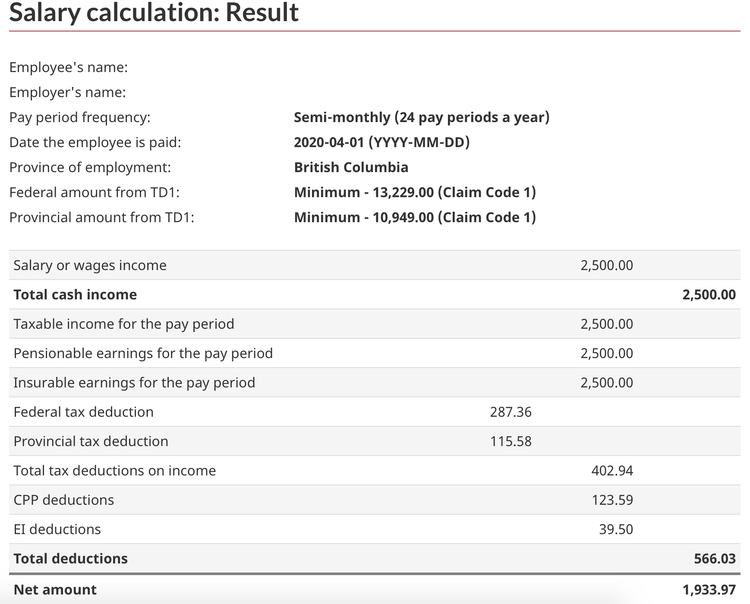

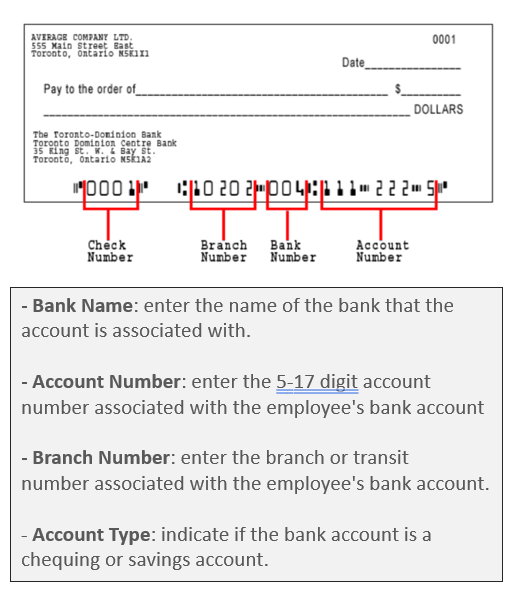

How To Do Payroll In Canada A Step By Step Guide

Mathematics For Work And Everyday Life

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Mathematics For Work And Everyday Life

Check Your Paycheck News Congressman Daniel Webster

The Measure Of A Plan

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

The Measure Of A Plan

:max_bytes(150000):strip_icc()/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Everything You Need To Know About Running Payroll In Canada

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

What Is Tax Withholding All Your Questions Answered By Napkin Finance

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate