Online payroll calculator 2023

The Salary Calculator - 2022 2023 Tax Calculator Welcome to the Salary Calculator - UK New. 250 minus 200 50.

Employed And Self Employed Tax Calculator Taxscouts

Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

. GetApp has the Tools you need to stay ahead of the competition. Then look at your last. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Ad See the Payroll Tools your competitors are already using - Start Now. Ad What Makes a Company is the Employees.

Get Started With ADP Payroll. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. Customers need to ensure they are calculating their payroll tax.

Ad Compare This Years Top 5 Free Payroll Software. 2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters. Ad Find 10 Best Payroll.

Updated for April 2022. Daily Weekly Monthly Yearly. 2022 Federal income tax withholding calculation.

Attract Retain Talent With The Help Of HR Tools. Ad Are you overspending on your payroll delivery. Free Unbiased Reviews Top Picks.

Use our employees tax calculator to work out how much PAYE and UIF tax. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. Subtract 12900 for Married otherwise.

The US Salary Calculator is updated for 202223. Under 65 Between 65 and 75 Over 75. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Return filed in 2023 2021 return filed in 2022. Get Started With ADP Payroll. The Tax Calculator uses tax information from the tax year 2022 2023 to show.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

FAQ Blog Calculators Students Logbook. Web For example based on the rates. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Under 65 Between 65 and 75 Over 75. Subtract 12900 for Married otherwise. If youve already paid more than what you will owe in taxes youll likely receive a refund.

See where that hard-earned money goes - with UK income tax National Insurance student. 2021 Tax Calculator. Free Unbiased Reviews Top Picks.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Ad Compare This Years Top 5 Free Payroll Software. Daily Weekly Monthly Yearly.

Find The Right System To Manage And Support Your Employees From Hire To Retire. Starting as Low as 6Month. It will confirm the deductions you.

The Salary Calculator has been updated with the latest tax rates which. Use our employees tax calculator to work out how much PAYE and UIF tax you. Subtract 12900 for Married otherwise.

Small Business Low-Priced Payroll Service. 3 Months Free Trial. Well calculate the difference on what you owe and what youve paid.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. See your tax refund estimate.

Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. That result is the tax withholding amount. The US Salary Calculator is updated for 202223.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account. Simplify your payroll accounting process with the best value in payroll software for small to mid-sized businesses.

Prepare and e-File your. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Get Started With ADP Payroll.

2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations. Ad Process Payroll Faster Easier With ADP Payroll. 2022 Federal income tax withholding calculation.

It will confirm the deductions you include on your. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Use our payroll calculator and make your cost savings real.

Download The Mortgage Payoff Calculator With Line Of Credit From Vertex42 Com In 2022 Mortgage Payoff Pay Off Mortgage Early Mortgage Amortization Calculator

2022 2023 Tax Brackets Rates For Each Income Level

Calculator And Estimator For 2023 Returns W 4 During 2022

Notice Period Calculator Moneyland Ch

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

Salary And Tax Deductions Calculator The Accountancy Partnership

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Tax Year 2023 January December 2023 Plan Your Taxes

Gross To Total Salary Calculator Stafftax

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

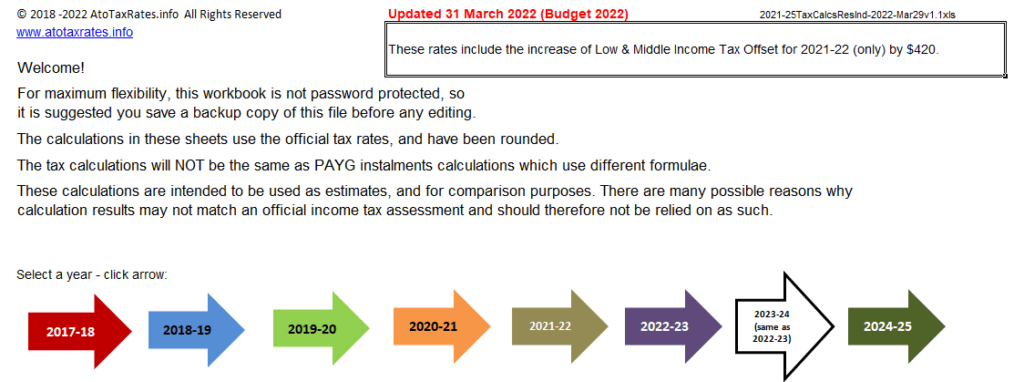

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

Debt Snowball Calculator Tutorial Our Debt Free Lives Debt Snowball Calculator Debt Snowball Paying Off Credit Cards

![]()

Gross To Total Salary Calculator Stafftax

Annual Leave Calculator Pro Rata Holiday Calculator

Pin On Budget And Finance

Income Tax Calculator Taxscouts

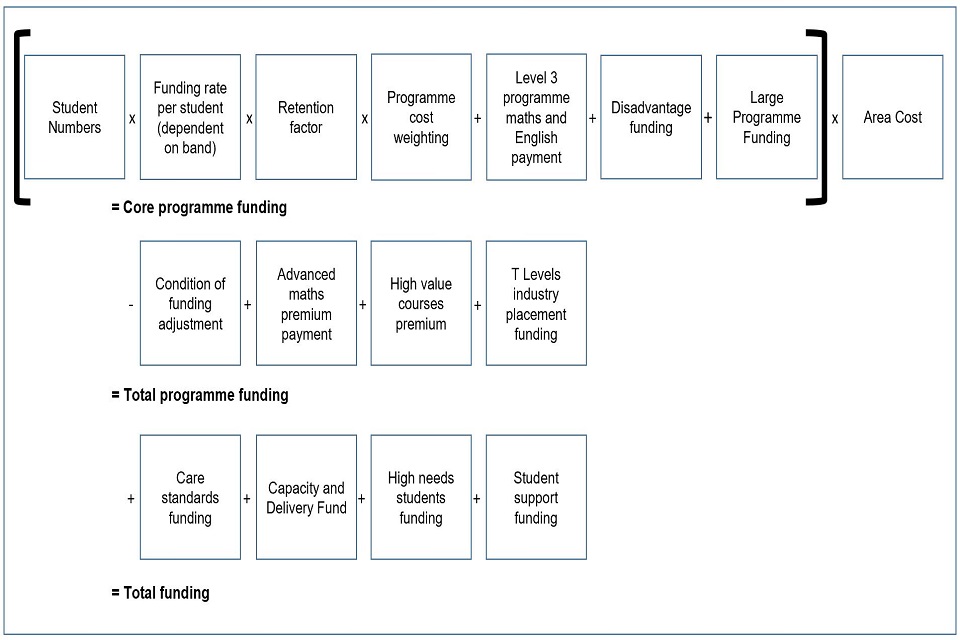

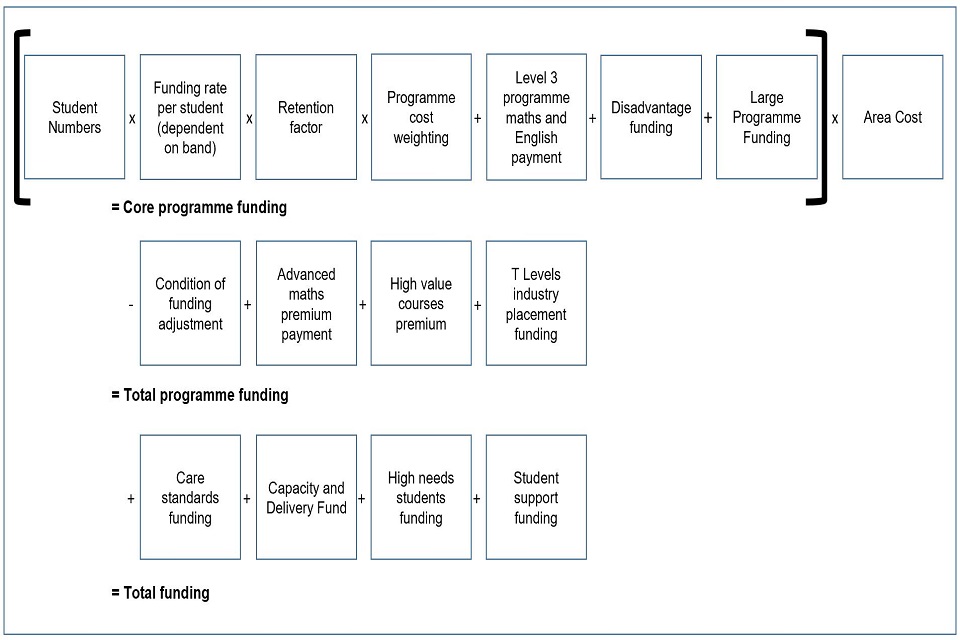

16 To 19 Funding How It Works Gov Uk